How often do you wish you had someone who would notify you about your daily budgeting? After all, tracking all your expenses while keeping up with your bank balance isn’t the easiest thing to do. This is where personal finance apps come in handy because they can connect with your bank account and help you manage your finances by figuring out where you spend the most, tracking upcoming bill payments, and keeping up with your investment portfolio.

To help you choose an ideal app that offers email/message reminders, bill due dates, shared wallets, and similar other features, we have listed the top 7 personal finance apps below.

1. You Need a Budget (YNAB) – Gain Total Control of Your Money

YNAB is designed so that you can plan your future financial decisions by following the ‘zero-based budgeting’ system rather than just tracking past transactions. This makes you more calculated when prompted to decide what to do with your money sincerely.

You can instruct YNAB on how much of your income should go towards your goals, expenses, and savings when you get paid. Due to this accessible decision-making capacity, YNAB is as hands-on as you can imagine.

You can link your savings and checking accounts, credit cards, and loans through the app, which works seamlessly on desktop, phone, iPad, Alexa, and even Apple Watch. Plus, it offers many educational resources mentioning how to budget and miscellaneous.

| Pros | Cons |

| Individuals can develop their fits, according to their respective needs. | It puts up a lot of time for users to comprehend. |

| If someone is looking for extraordinary and standard security, they should opt for YNAB. | If someone is looking for the option to separate the bills, they won’t get it. |

2. Mint – Managing money, made simple

Mint has a very high rating in both Google Play and App Store. It is free and seamlessly syncs with your checking and savings accounts, credit cards, loans, bills, and investments. If you consider the actual budgeting, Mint helps track your expenses and places them in budget categories that you can personalize or set limits for the same.

Mint is also helpful in several ways, like helping you pay down debt, track goals, and save money. It also shows your credit score and net worth, providing customer support for operating the app and a detailed FAQ.

However, it may not be suitable if you want to be more hands-on in your budgeting.

| Pros | Cons |

| Users earn a free credit score courtesy of Equifax. | If users are looking for the option that will provide them with a bill-paying quality, then this will disappoint them. |

| Users also get very susceptible to help and backing. | This is also unable to support numerous currencies. |

3. Goodbudget – Budget with a why Spend, save, and give toward what’s important in life

If you want an app that plans your finances instead of tracking previous transactions, then try Goodbudget. The app is based on the ‘envelope budgeting’ system, wherein you portion your monthly income towards specific spending categories (or envelopes). Since Goodbudget doesn’t connect your bank accounts, you have to manually add account balances, cash amounts, income, debts and every expense and assign money towards each envelope.

You can access Goodbudget from your desktop or phone. The app offers a free version that allows one account, two device access, and a limited quantity of envelopes. However, its paid version, “Goodbudget Plus,” allows unlimited accounts and envelopes, up to five devices, and other perks.

| Pros | Cons |

| Users get to use this on several appliances. | Users get a limited plan that will not cost any charge. After that time period , they have to pay to continue with it. |

| A lot of users can use it at the same time. | Users get a very short number of features in comparison to other ones. |

4. Prism – Magic for your bills All your bills at a glance, always up to date

If keeping track of your recurring bills tires you out, you can switch to Prism. Prism organizes all your sporadic bills in one place automatically while giving you an easy view of your account balance and due dates.

Although connecting each of your accounts individually takes a little time. But once that’s done, the app will automatically sync all your balances and account bills. You can then set up personalized notifications and pay your bills on time directly from the app so that you don’t miss a payment again. This will further improve your credit score a lot!

| Pros | Cons |

| The queries are settled very soon. | This is extremely graphically clumsy for the users. |

| This provides a ton of flexibility to the users. | Users are sometimes untrained to use it due to advanced computation. |

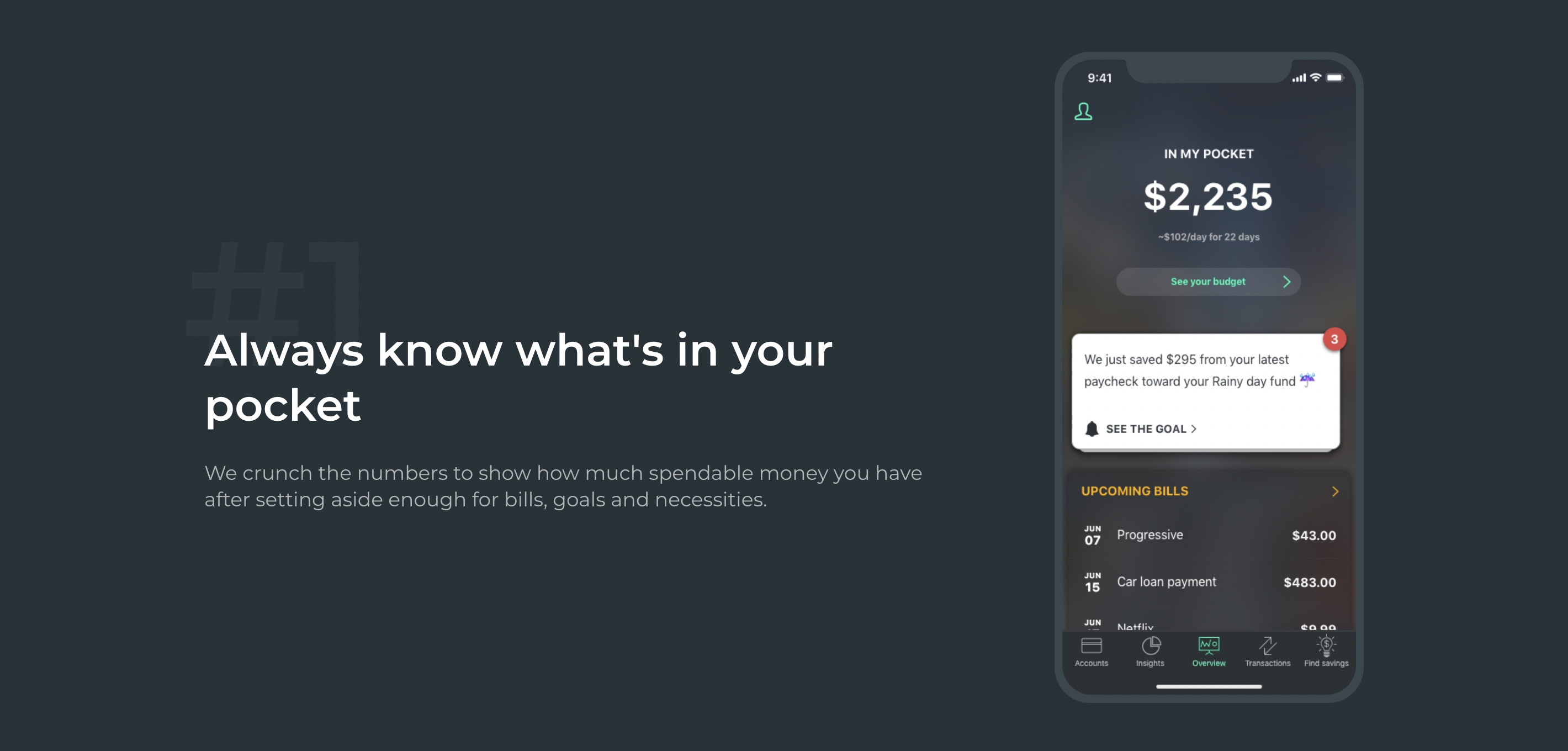

5. PocketGuard – Personal finance simplified

If you have a knack for overspending and are unsure how to break this habit, download PocketGuard!

As the name suggests, PocketGuard links all of your financial accounts seamlessly, thus helping you keep proper track of your expenditures every month. Even if you don’t consider yourself very tech savvy, its super easy application will help you set up and link your bank accounts in mere minutes!

| Pros | Cons |

| Users are able to assemble the appropriations. | Users will not be able to use the free version for a long time. |

| Users are also able to establish the goals of savings. | This asks their users to sync the accounts. |

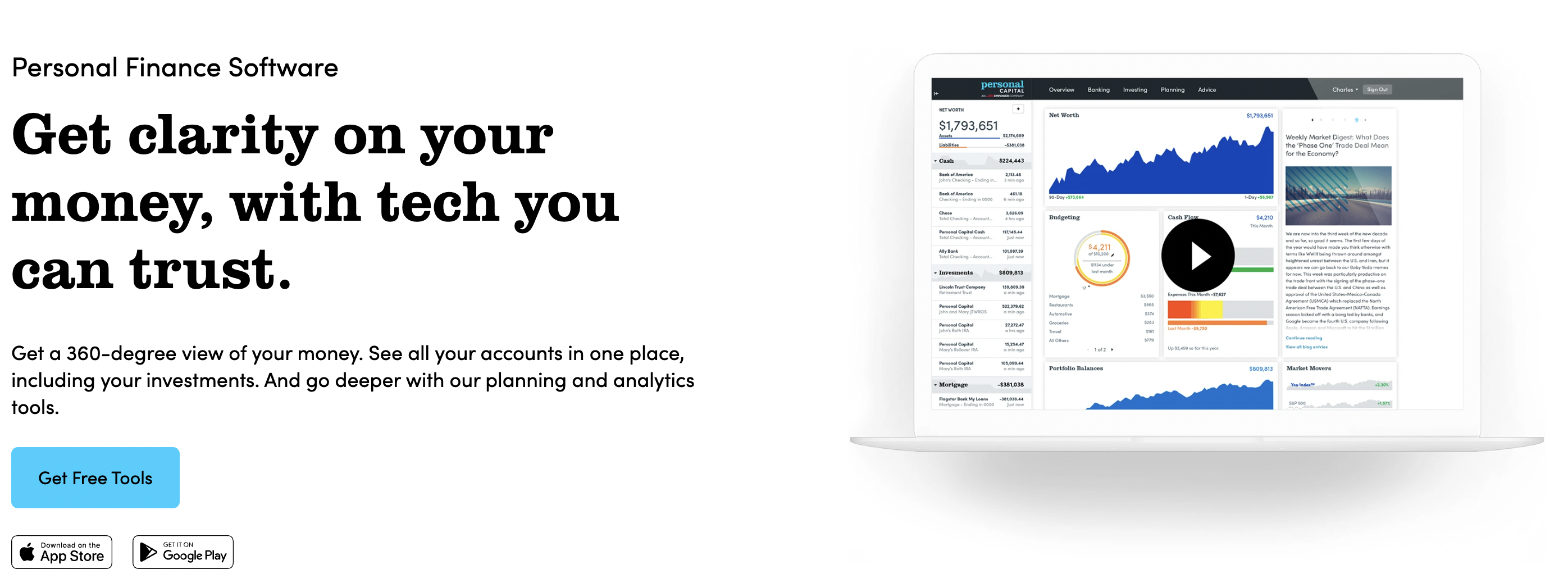

6. Personal Capital – Get clarity on your money, with tech you can trust.

Primarily an investment tool, Personal Capital is helpful for budgeters looking forward to tracking their expenditures. This free app includes features that monitor checking and savings accounts, credit cards, IRAs, mortgages and loans. Personal Capital then gives you a spending snapshot by listing recent transactions through customizable categories to see the percentage of total monthly expenditure each type represents.

The app also serves as a net-worth and portfolio tracker and can be easily accessed through both desktop and phone.

| Pros | Cons |

| Users get personal safety with this. | It requires a very elevated management fee. |

| Users who are financial consultants , get a ton of windfalls. | Users have to have $ 100,000 with them to use it. |

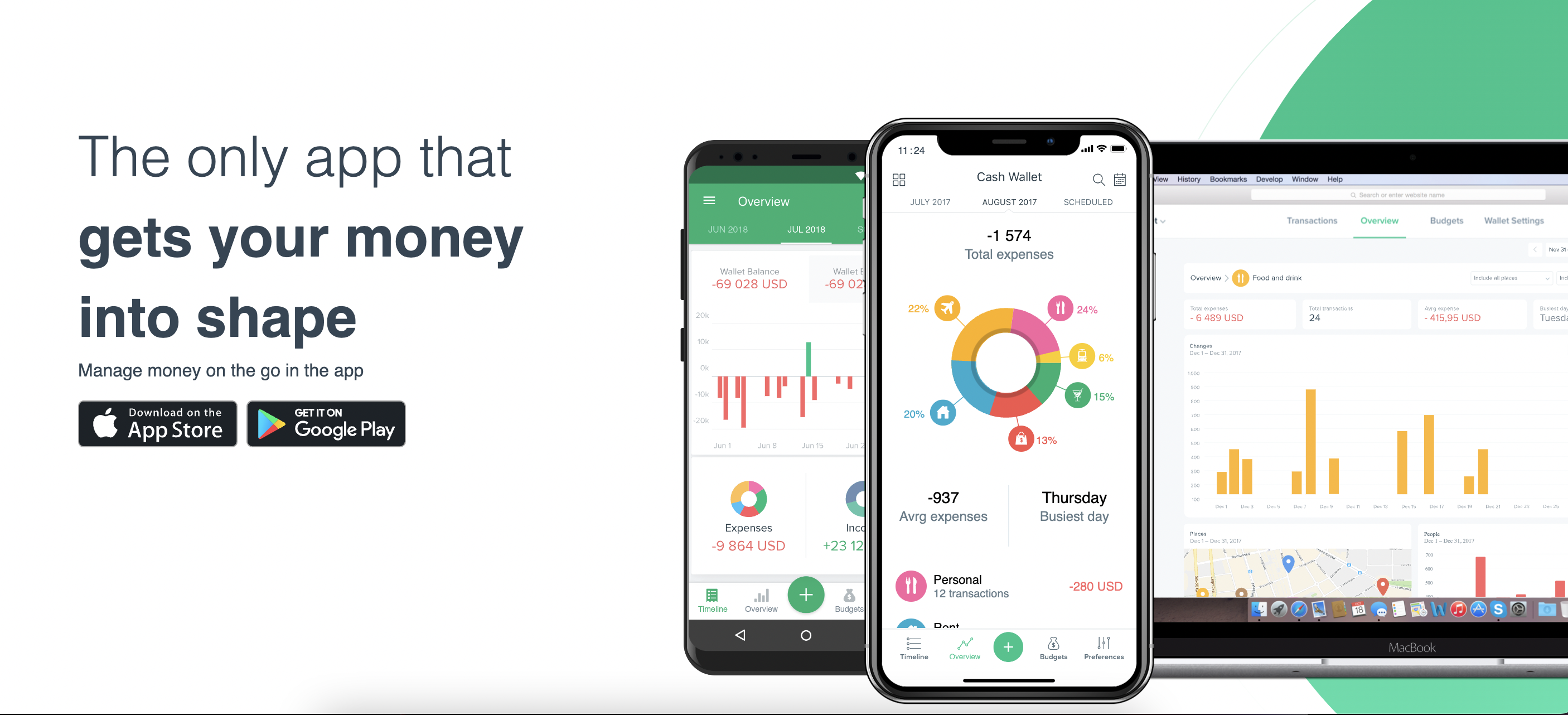

7. Spendee – The only app that gets your money into shape

Spendee will be perfect if you don’t want to connect your bank account to a budget tracking app. This app has an aesthetic yet easy-to-use interface that will make you want to try it out for once.

Since the app doesn’t sync to your bank account or credit cards, you must manually enter all the correct values of your income and expenses. But if you put in the much-needed effort, this app will allow you to track and analyze your costs more accurately than most of the automated finance apps available!

| Pros | Cons |

| Users are able to have supervision over their money in all their accounts. | There are a few specific banks who are not endorsing this. |

| It also provides smart budget options to the users. | Users get amazing windfalls of this only with the restricted paid plan. |

Conclusion

Likewise, there are multiple other personal finance apps that can go hand-in-hand with some of the apps we mentioned above. You have to figure out how you want to track where your money is going (and perhaps tweak your spending), irrespective of the app you choose.

2 thoughts on “Manage Your Personal Finance on the go with 7 apps to retire rich.”